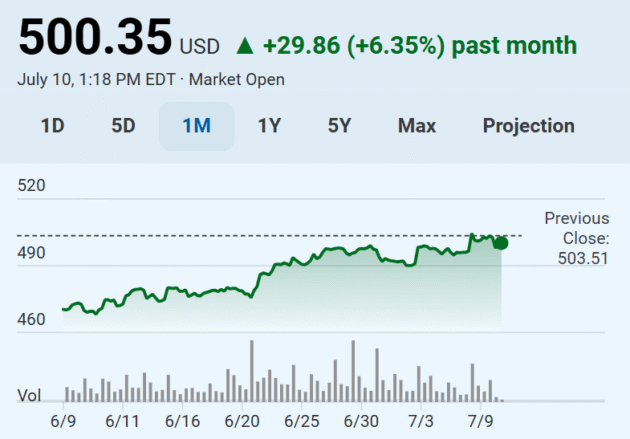

Microsoft shares closed above $500 for the first time Wednesday — a symbolic milestone as Wall Street increasingly bets on its role in the AI boom.

The Redmond company’s market value is more than $3.7 trillion, and Wedbush analysts predicted Thursday morning that the company is on its way to a $4 trillion valuation. That was a mark briefly reached by Nvidia earlier this week, driven by demand for its AI chips.

“We believe Microsoft will also hit the $4 trillion market cap club this summer and then over the next 18 months the focus will be on the $5 trillion club,” wrote Wedbush analyst Dan Ives and colleagues in a note to clients, saying they believe the AI-driven tech bull market is still in its early phases.

Microsoft is making AI investments across cloud services, including Microsoft Copilot, Office and GitHub. It also continues to benefit from its high-profile partnership with OpenAI, even as that relationship evolves.

It’s spending heavily on AI infrastructure with $80 billion in annual capital expenditures in its recently completed fiscal year.

At the same time, Microsoft has been shedding jobs, cutting around 15,000 positions over the past few months, citing a desire to boost efficiencies. Speaking with reporters on Wednesday, Microsoft President Brad Smith said AI was “not a predominant factor” in the job cuts.

Microsoft saved more than $500 million last year using AI in its call centers, while also boosting employee and customer satisfaction, according to a Bloomberg News report, citing an internal presentation by Chief Commercial Officer Judson Althoff.

In its latest AI initiative, Microsoft on Wednesday announced a $4 billion commitment over five years to help schools and nonprofits adopt AI through a new program called Microsoft Elevate. The program, which includes cash and technology donations, aims to train 20 million people in AI skills over the next two years.

Read the full article here