Microsoft is expected to report continued strength in its cloud business Wednesday, powered by growing corporate demand for artificial intelligence, as the human and financial toll of its rapid AI transformation becomes more clear.

Wall Street expects revenue of $73.83 billion and earnings of $3.38 per share for the fourth quarter of Microsoft’s 2025 fiscal year, according to Yahoo Finance, representing earnings growth of more than 14% from a year earlier.

The report comes as Microsoft boosts capital spending to expand its AI infrastructure, increasing revenue through offerings such as Azure OpenAI Services and GitHub Copilot. But that spending is also creating pressure to rein in operating expenses — the backdrop for its recent layoffs of more than 15,000 employees.

Microsoft’s broad investments in AI “should support share gains and durable growth ahead,” wrote Morgan Stanley analysts Keith Weiss and Josh Baer in a July 22 research note. They cited “strong opex discipline” as another factor.

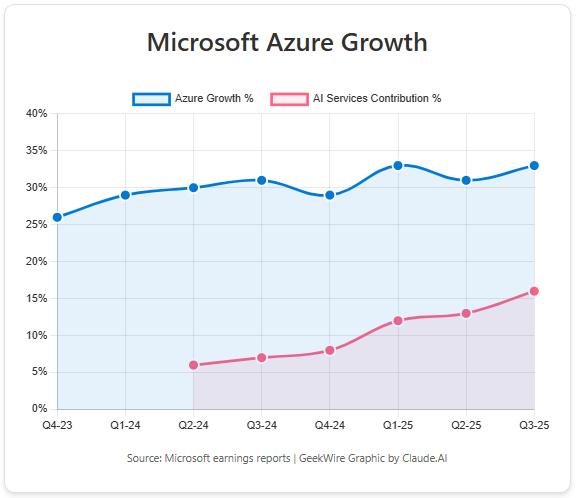

In the third quarter, revenue from AI services contributed 16 percentage points of growth to the overall 33% growth in Microsoft’s Azure business — the highest to date — illustrating the central role of artificial intelligence in driving the company’s cloud momentum.

A key factor is corporate demand for OpenAI’s technology, under Microsoft’s partnership with the ChatGPT maker. Bloomberg News reported Tuesday that Microsoft and OpenAI are in talks over new deal terms that would give Microsoft longer-term access to OpenAI’s technology while helping OpenAI convert to a for-profit entity.

Microsoft Cloud revenue, which includes Azure, Microsoft 365, Dynamics 365, and LinkedIn commercial services, reached $42.4 billion in the third quarter, up 20% from a year earlier — reflecting strong demand for its enterprise software and cloud infrastructure services.

At the same time, Microsoft’s capital expenditures reached $21.4 billion in the third quarter, part of an estimated $80 billion in annual infrastructure spending.

As a result, Microsoft said gross margins in its cloud business declined to 69%, down from 72% the year before, reflecting the cost of building and expanding its data centers to accommodate growing AI workloads, and developing and acquiring AI-optimized chips.

Microsoft President Brad Smith, in a recent press conference and interview with GeekWire, said internal AI efficiency gains were “not a predominant factor” in the company’s layoffs, instead citing shifting priorities and the need to reallocate resources. However, he acknowledged that rising capital expenditures have created pressure to reduce operating costs, which consist largely of employee headcount.

In a memo to employees last week, Microsoft CEO Satya Nadella acknowledged the “uncertainty and seeming incongruence” of thriving financially while undergoing major layoffs.

“This is the enigma of success in an industry that has no franchise value,” he wrote. “Progress isn’t linear. It’s dynamic, sometimes dissonant, and always demanding. But it’s also a new opportunity for us to shape, lead through, and have greater impact than ever before.”

Even with the layoffs, Nadella said the company’s overall headcount is “relatively unchanged” due to ongoing hiring. The company employed 228,000 people a year ago, and will report the new number in its upcoming annual 10-K filing with the Securities and Exchange Commission.

Microsoft reports earnings after market close Wednesday. Check back for full coverage and analysis.

Read the full article here