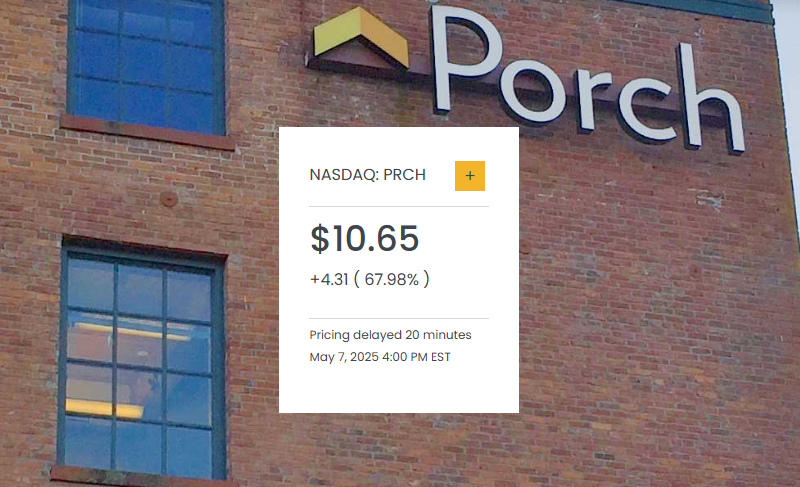

Porch Group’s stock shot up nearly 68% on Wednesday, a day after the company reported a surprise profit and raised its outlook for the year — a sign that the latest overhaul of its business is starting to show results for the Seattle-based provider of home services software and insurance products.

The key was strong performance in Porch’s insurance-related operations, following a shift away from directly selling policies, earning fees by managing them instead.

“I’ve never been more excited to report on quarterly earnings as I am here for Q1 2025,” said Matt Ehrlichman, the company’s CEO, on the company’s conference call Tuesday.

In January, Porch sold its insurance carrier (Homeowners of America) to a new member-owned reciprocal exchange, which it now manages for fees and commissions rather than owning directly. The change was designed to generate more stable, high-margin revenue without the financial risks from storms and other costly disasters.

Ehrlichman, who founded Porch in 2012 as a home services marketplace, said the quarter “marks a special time for the company,” moving away from covering costly weather-related claims while still benefiting from the steady growth of the homeowners insurance market.

Porch posted a profit of $8 million in the first quarter, compared with a loss of $24.4 million a year earlier. Revenue totaled $84.5 million, with gross profit of $69.1 million and an 82% gross margin.

Earnings were 2 cents per share, beating analyst expectations of a 7 cent loss. Citing stronger-than-expected performance, particularly in insurance, Porch raised its full-year forecast and now expects up to $70 million in adjusted EBITDA for 2025.

Porch started in 2012 as a marketplace connecting homeowners with local service professionals, later expanding into software tools for home inspectors, mortgage lenders, and other real estate businesses. Over time, it added insurance and warranty products to its lineup.

The company went public in late 2020 — part of a broader wave in which startups bypassed traditional IPOs by merging with special-purpose acquisition companies (SPACs) in an era of easy capital and bullish investor sentiment.

As of December 31, 2024, Porch Group had 733 employees, down from 895 a year earlier, according to its annual regulatory filings.

Read the full article here